How You Can Find Product/Market Fit and Avoid the Risk of Failure

1. What is product/market fit

2. Product/market fit vs. idea validation

3. Define product market first

4. How to identify if you have a fit

5. How to find product/market fit

6. How to measure product/market fit

7. Most common myth and misconceptions of product market fit

Useful tools:

1. Newoldstamp - Email signature marketing

2. Mailchimp - Email builder and sender

3. Reply.io - Personal email outreach, calls, and tasks

4. RocketLink - Your branded short linker

5. Canva - Online tool for making designs

Product/market fit is an important concept when it comes to working on a new product. All entrepreneurs and product managers seek to achieve product/market fit. But if you ask what this means, most of them probably won't be able to give a clear answer. Even more frequently, they have no understanding of how to measure product/market fit using metrics.

Without a clear definition, any concept is useless. So, today we look at the most common criteria for product/market fit, discuss myth & misconceptions, and learn how to measure product/market fit.

What is product/market fit

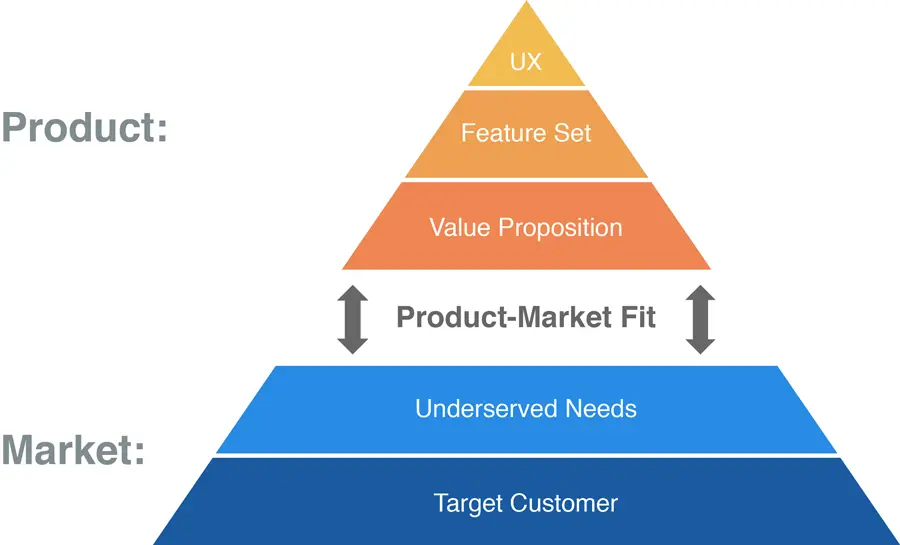

When you have a product that meets the needs of a specific market, and without which your audience will lose a lot, this is called product/market fit (PMF).

source: leanstartup

This product/market fit definition belongs to Marc Andreessen, the co-founder of a famous Silicon Valley venture capital firm Andreessen Horowitz and co-author of the Mosaic browser.

Product/market fit vs. idea validation

Before we start examining this topic, let's agree not to confuse product idea validation with product/market fit. Idea validation is when you saw that prospective buyers were willing to pay for your product. Check out our article “How to Validate Your Product Idea Before Wasting Your Time and Money” to learn more.

Product/market fit is the ultimate kind of idea validation. Once you have validated your product idea, then you start looking for PMF.

Define product market first

In fact, if you want to grow your business, you need to ensure customers want your product/service and, ideally, can't live without it. Also, make sure the market is large enough to sustain your growth. Namely, you need to verify if there are enough potential customers and enough of them are going to buy the product.

How to identify if you have a fit

-

Sean Ellis test

One of the most effective ways to measure the viability of your product or its individual features is to use the Sean Ellis test. This is a product/market fit survey that will help you find out what users think about your product, how well it solves their problems, and what needs to be done to improve it. The main question of the test is as follows: “How will you feel if you can no longer use our product?”. The respondent is offered to choose from the following options:

- Very disappointed

- Somewhat disappointed

- Not disappointed (the product really isn’t that useful.)

If more than 40% of users respond that they will be “Very disappointed,” you have every reason to expect steady, scalable growth.

Slack, an American software company, once used this test. As you can see from the results, Slack software had become irreplaceable for most of its customers. Isn’t that obvious that it is one of the most important reasons behind its success?

source: pisano

-

David Cummings test

Another popular approach to finding product/market fit is conducting the David Cummings test. It is relatively simple: if you are able to satisfy all the following criteria, you have a good indication that you have achieved product/market fit.

- Criteria #1: Ten or more customers have signed up in a short period of time (3 - 9 months). Keep in mind that only legitimate customers count. Exclude people with an existing relationship to you or those trying your product/service as a favor;

- Criteria #2: You know at least five customers who actively use your product with little or no customization. If you can answer “yes,” then most likely your product can bring value in its current state and doesn't require significant modification to make it useful to each new user;

- Criteria #3: At least five customers have used your product for a month or more without reporting a bug;

- Criteria #4: At least five customers use your product in the same way and achieve similar results. It's common to see the first customers using your product in various weird and unintended ways. Once you see it is used consistently, you can be sure that your product is ready to scale.

- Criteria #5: At least five users demonstrated a similar acquisition and onboarding process. In addition to using your product in a consistent way, your customers need to sign up and start using it in a repeatable manner.

-

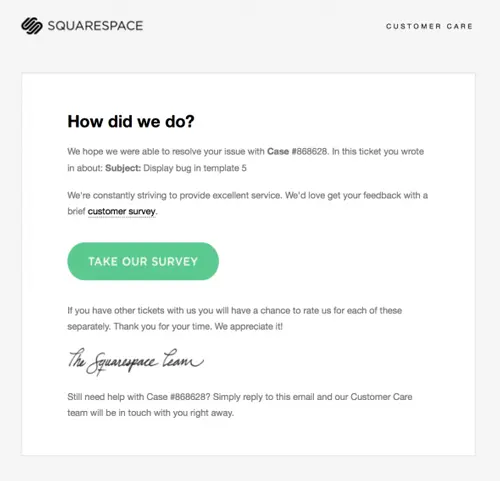

Interview your clients

One of the greatest ways to understand if you have product/market fit is to listen to target groups. Use questionnaires with questions such as: what pain points they experience; for which purpose people use your product the most; whether it is used in the way you have foreseen or not; how they heard about your product, etc.

source: reallygoodemails.com

-

Talk to your sales and support teams

Every team member from those who are building products to those who interact with clients should understand that they are hunting for product/market fit. Why is this useful to involve everyone? For example, if you keep in touch with your sales and customer support teams, you have access to the data such as what customers are complaining about or struggling with.

How to find product/market fit

-

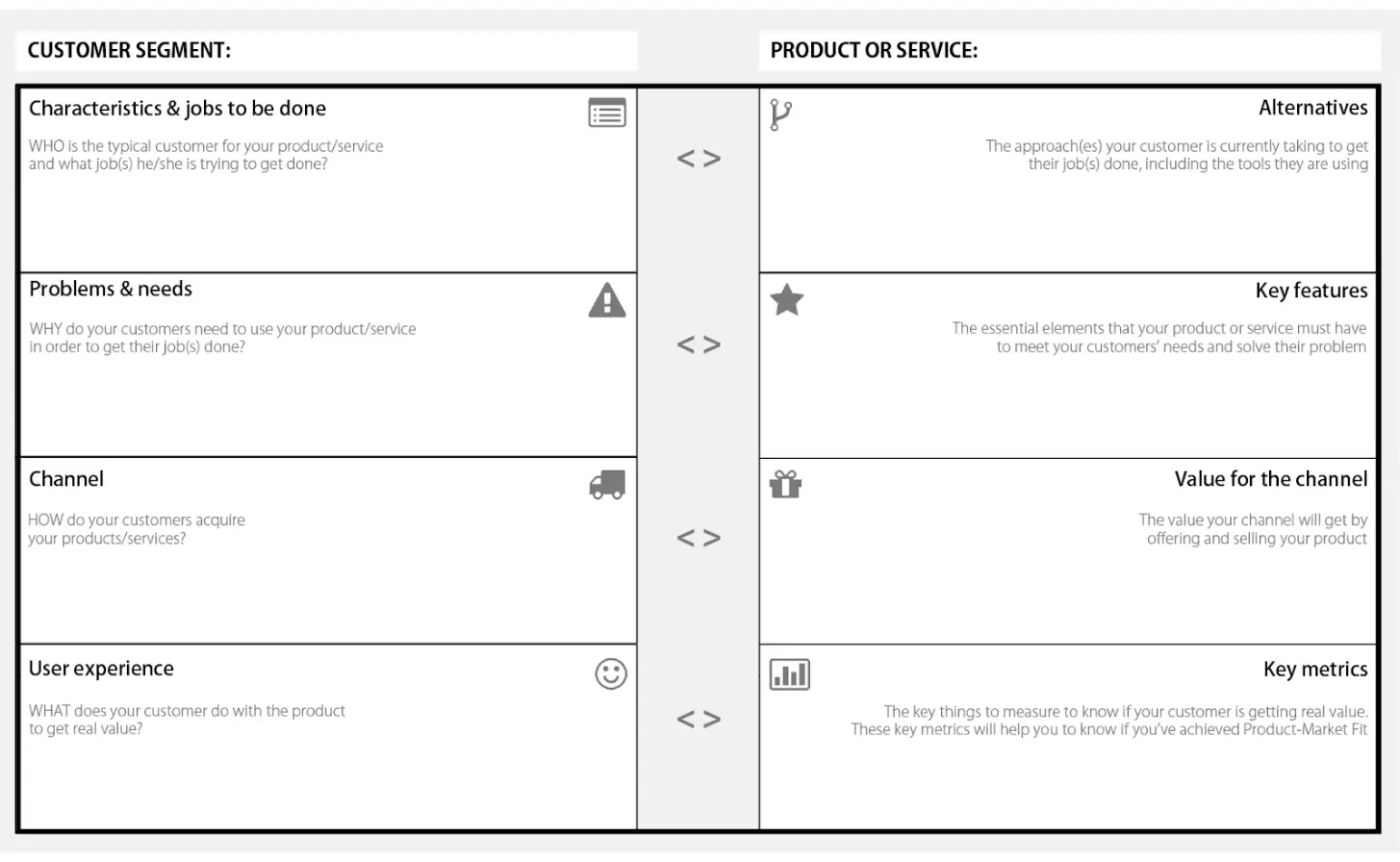

Create business model canvas

Product/market fit canvas will help you understand who your clients are and what you can do to meet their needs and build relationships with them. On the image below, you can see a template that is divided into two segments. The first segment will help you with an initial analysis of your target audience. The second segment will be helpful for analysis after the launch of your product when you evaluate how it fits into the overall market.

-

Segment industry verticals and buyer personas

Create a list of different industry verticals you think have the “pain” for which you have a solution. Research these verticals one by one to see how you might fit into them, because benefits delivered, positioning, style of messaging, pricing, etc. often need to be different for each vertical. Understanding any market means understanding the audience in that market. So as you learn more and more about that audience, create and periodically revise buyer personas. What are their age and gender? What is their role at the company? Are they decision makers? and so on.

-

Find and understand the pain points of your target customers

One of the greatest ways of conducting market research is actually talking to your target audience. And not only using some online survey. It is even better if you can arrange an actual face-to-face or phone meeting. Ask your potential customers what their biggest challenges around your industry are, or how much they would be ready to pay for a thing that solves their problem. You would be surprised what useful insights you could get this way.

-

Test your value hypothesis to form your value proposition

Once you found out the pain points of your target customers and explored their needs, it’s time to form a winning value proposition. You should understand that the market might be full of similar products or services. That's why it is critical to come up with something really innovative to win customers’ hearts and beat your competitors.

-

Make your minimum viable product (MVP) to cover key customer pains

Create the earliest version of the product with the most important features. This will allow you to test your idea before building the final product.

-

Test your MVP on potential customers

After building an MVP, start gathering customer feedback to see whether your product solves a problem for customers or not. There are numerous ways that you can apply to test your MVP. Those include landing pages, customer surveys & interviews, Kickstarter campaigns, pre-orders, etc. For example, a custom email signature generator can be a valuable MVP for businesses looking to provide a quick solution for brand consistency, gather insights from users, and iterate on the product based on real-world usage.

How to measure product/market fit

There are several metrics you need to track to see whether you have achieved product/market fit or not. Let’s go through each metric separately.

-

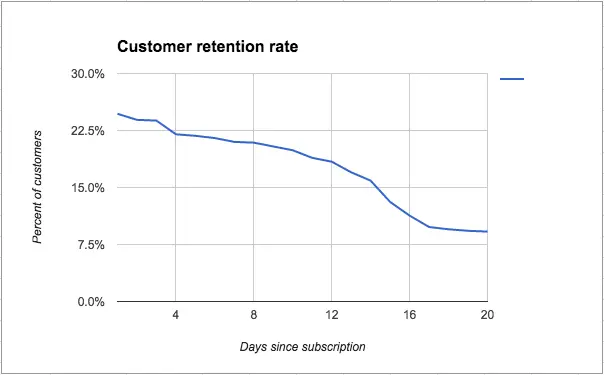

Retained engagement rate

Retained engagement is the metric that shows how much time people interact with your product or service in a given period of time. If a certain number of new users started interacting with your product, and then they stayed, you have nailed the engagement (in other words, people love your product).

source: appcues

-

Churn rate

Churn is the percentage of people who cut ties with your company (product/service) during a given time period. A high churn rate is a certain indicator of customer dissatisfaction. This means the product still needs to be improved to reach product/market fit. According to Andrew Chen, a general partner at Andreessen Horowitz, your churn rate should be 2% or lower per month. Other experts say that you should strive to achieve a churn rate below 6%. The higher churn value can indicate a product problem or a weak market.

-

The rule of 40%

This metric is really simple. Ask prospective buyers the following question: “How would you feel if you could no longer use this product?” Sean Ellis, the inventor of the 40% rule explained:

“If you are above 40% of the people saying they would be very disappointed, I tend to say you have found product/market fit, and if you are less than that, you haven't.”

-

Customer lifetime value

The customer lifetime value shows how much one customer is worth. For instance, if a customer pays $10 per month on a 12-month contract, then the average customer is worth $120. Also, make sure you took into account a churn rate. If it is 10%, then subtract that from the lifetime value of a customer, which drops it to $108. A high lifetime value indicates a strong market and satisfied customers.

-

Web analytics metrics

Most common web analytics metrics to consider are bounce rate, time on site, pages per visit, returning visitors to new visitors ratio. Let’s go through each of them.

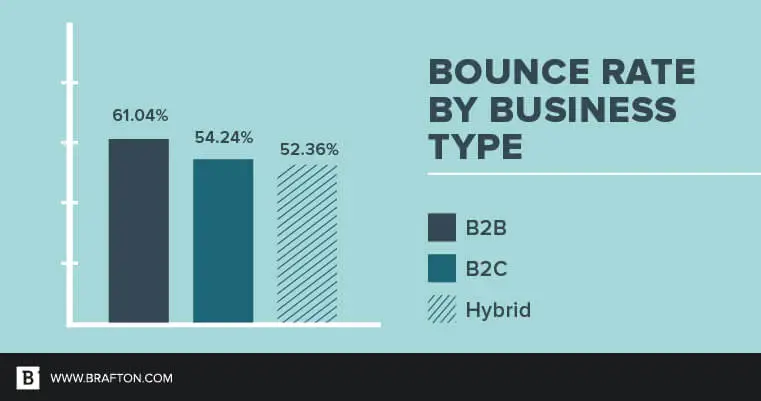

The bounce rate of product pages

This is the percentage of people who visit a page on your site and then leave it without taking any action. If you see the bounce rate around 60%, your website is most likely not giving the right first impression to its visitors. And the lower the bounce rate is, the more likely users' expectations are met. However, keep in mind that visitors can bounce not because your product is useless but because of poor design or bad quality content.

source: brafton

Time on site

Time on site is another metric you can use for product/market fit analysis. In theory, the longer the visitor stays on your website, the more interested they are. According to statistics from Brafton, a content marketing agency, the average time on page for 181 sites which they surveyed was 2 minutes and 17 seconds. But it's important to understand that this metric depends on what kind of content your website has. For example, if it has much text, and the average time spent on that page is no more than a couple of seconds, then it needs your attention.

Pages per visit

This is the average number of pages viewed by a user during a single session. But how many pages per session is good? If the visitor checks more than 4–5 pages per one session, it can be considered a high number already.

Returning visitors vs. new visitors

The ratio of new visitors to returning visitors can provide valuable insight into what you are offering to your audience. Pay attention that the average rate can vary based on the type of website, business, etc. Depending on what kind of product you offer, you might not expect regular / any repeat visits from the same customer.

Most common myths and misconceptions of product market fit

Ben Horowitz, the co-founder of a famous Silicon Valley venture capital firm Andreessen Horowitz, outlines four common myths associated with product/market fit.

-

You shouldn't be afraid of competition if you have product/market fit

Even if your product achieves PMF, you should still remember about the competition because the best markets are usually the ones in which competition is intense.

-

You found product/market fit for the whole market

There is a common misconception that it is possible to find product/market fit for the whole market. Most likely, you can achieve PMF for some market segment but not the entire market.

-

Your product/market fit will last forever

In this article, Ben Horowitz explains that they achieved product/market fit, but then the market changed dramatically, and they had to look for product/market fit in a different set of markets altogether.

-

Product/market fit is a big bang for your startup

Although some businesses achieve primary product/market fit in one big bang, for others it is a gradual, continuous process.

Final words

If you ask entrepreneurs what the most critical factor to the success of their business is, a lot of them might answer: “The team.” If you ask engineers or software developers the same question, they would probably say that the product is key to success. While both aren't entirely wrong (because a good product and a dedicated team play a huge role), what’s even more important is not to overlook the largest contributor to success or failure: the market. “Product market/fit means being in a good market with a product that can satisfy that market.” - said Marc Andreessen who presented the product/market fit term to the world. So if you want to succeed, first make sure that enough people love your product. Next, you need to figure out why. And only then you can start building the business based on what people like and need.