Effective Ways to Increase Survey Response Rate

1. How to calculate response rate?

2. What is considered to be a good survey response rate?

3. What are the pros of a high response rate?

If you run a business, you definitely do your best to please your customers, address their needs, and keep them loyal to your brand. But how do you know that your efforts bring desired results? In case you don’t try to figure out what your supporters actually think about your product or service, you will never be able to provide them the best customer experience.

Customer feedback helps businesses measure customers’ satisfaction, improve their products and services, create the best customer experience, improve customer retention, and make better business decisions.

In this article, we will discuss some practical ways that can help you reach your customers, gather valuable feedback, and improve survey response rate.

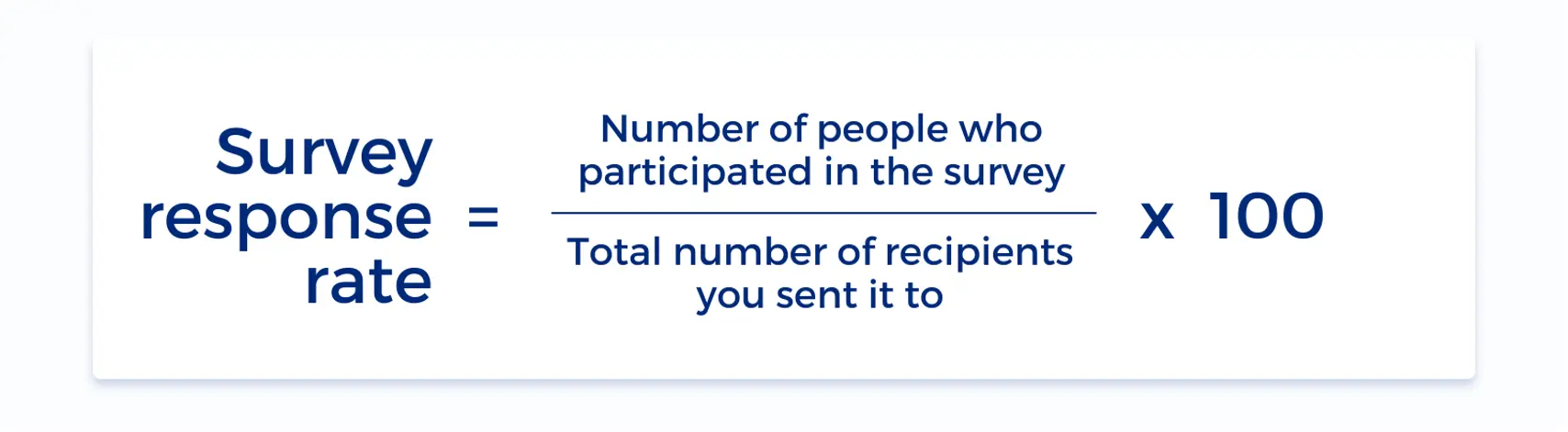

How to calculate response rate?

To understand your survey response rate, you can use the following formula:

This will give you your survey response rate as a percentage.

For example, 300 people / 1000 people x 100 = 30%.

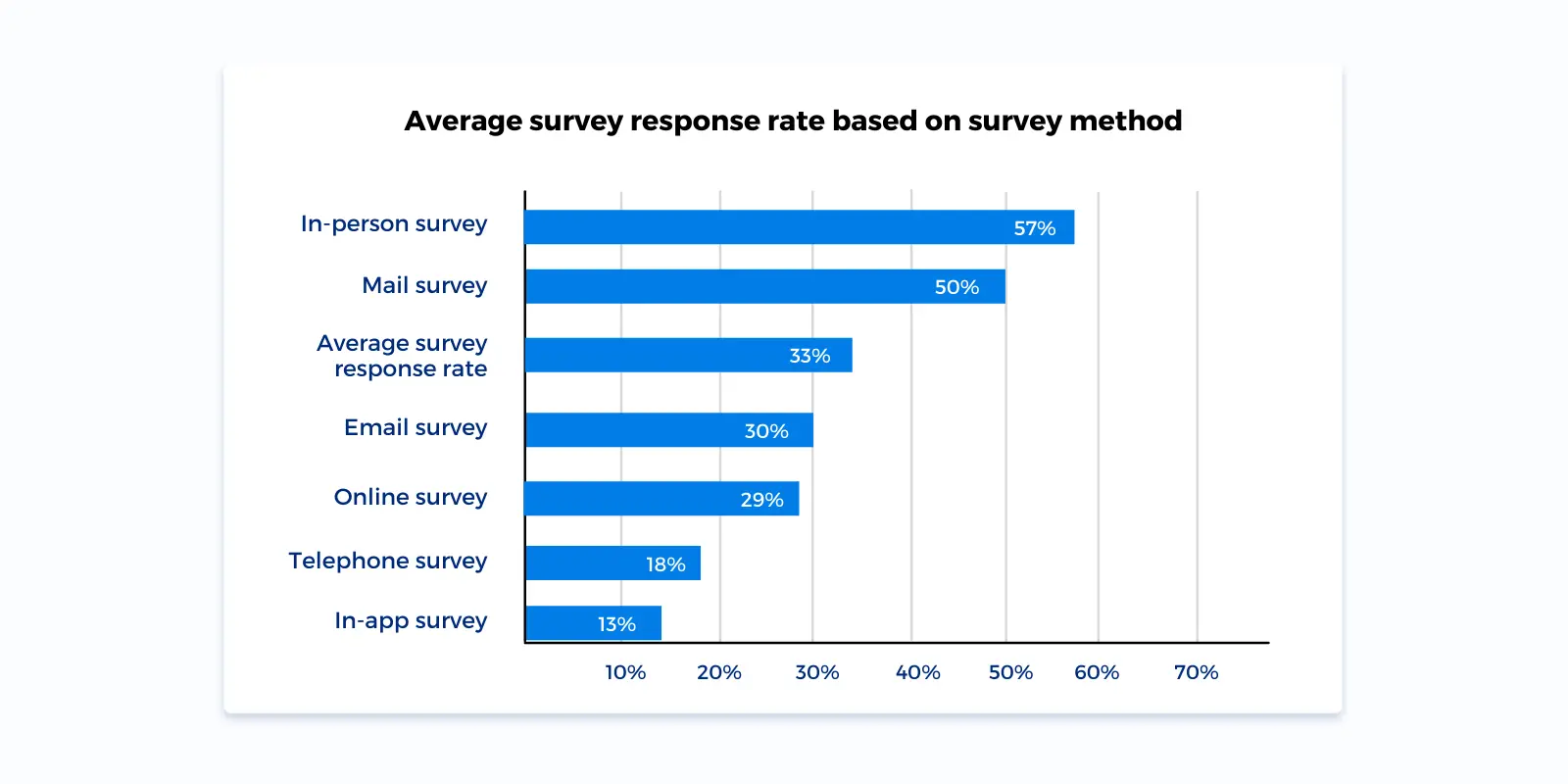

What is considered to be a good survey response rate?

As a rule, the numbers seem to fall between 20% and 30%. A rate below 10% is considered pretty low.

source: Survey Anyplace

What are the pros of a high response rate?

Having a high response rate is essential because it has an impact on your data quality.

Lower response rates mean a smaller amount of data. And when you have survey responses from a smaller group of people, there is a bigger chance that the survey respondents who participated may not be diverse enough to reflect everybody in the target group.

So, what can you do about that?

1. Identify your target audience beforehand

To be able to approach your potential responders efficiently, make sure you know who they are. Learn their key demographics such as sex, average age, occupation, etc. Think about if they would rather complete your survey via email, online, in messengers, or SMS.

Keep in mind that younger people typically have the lowest response rates when it comes to surveys. However, this can happen because the purpose of the survey isn’t clear. So investigate your audience and adjust your survey questions, topics, and purpose accordingly. Tell potential respondents what the purpose of the survey is and how their answers will be used.

source: Survey Monkey

2. Make it personal

People like to talk with people. Your survey response rates will go higher if you start your emails with “dear + recipient’s first name.” This simple personal touch makes your recipients feel valued. As we mentioned earlier, you can also take it all one step further and customize your question types to various target audience groups to receive more relevant answers.

3. Create a good survey invitation

Before you ask people to participate, make sure you answer the following questions in your survey invitation:

- What is the purpose of your survey?

- How much time will it take them to complete the survey?

- What is in it for them?

4. Pay attention to design

It may seem obvious but let us emphasize that your survey design is crucial. It should support the intuitive flow of the questionnaire. Make it easy for the recipients to read and follow the questions. This can be achieved by adding some logic or branching. Also, consider using more interactive and engaging question styles like rating scales and sliders.

source: Just in mind

5. Don’t wait for too long

Survey response rates grow when you ask customers for feedback immediately after they receive products or services. According to a study conducted by Gartner, immediate customer feedback is 40% more accurate than the ones collected just 24 hours later.

6. Choose the right channel(s)

Make sure you are looking for survey respondents in the right place. For example, some people may prefer email; others want to be reached out by text messages (SMS). You can also distribute your online survey on social media.

But shall you send one survey to each potential respondent only once?

You already have your customers’ email addresses, so the easiest way to ensure your questionnaire reaches them is to send it by email. But chances are they ignore the survey.

So you can try some other ways of gathering feedback from your customers. For example, include the survey in your newsletter or add a survey link in your professional email signature. Don’t hesitate to follow up at least one time.

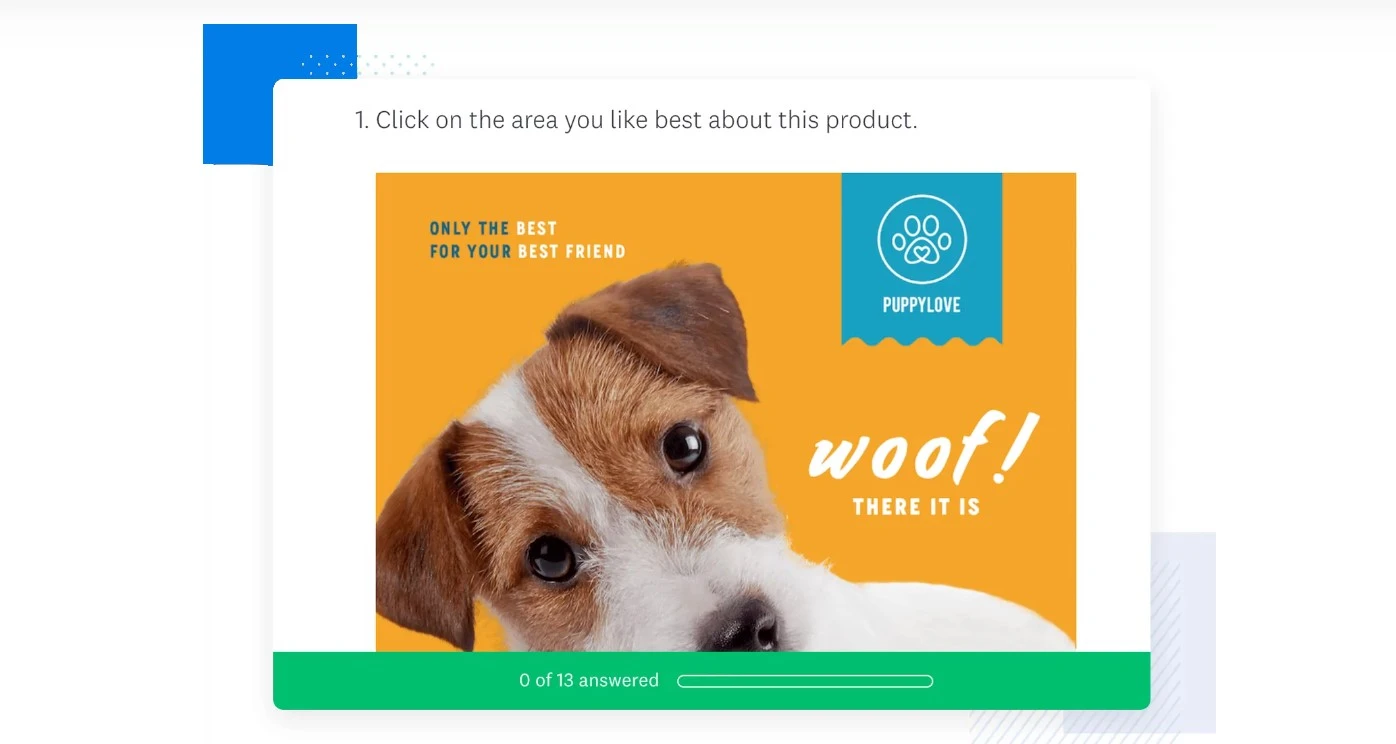

7. Use a progress bar

Showing a progress bar helps respondents understand what the total length of the survey is. When they know how much time it takes, the chances they complete your survey increase.

8. Optimize your surveys for various devices

Just think about how many people use their mobile devices to check email and interact with their favorite brands. These days, a responsive design has already become the standard.

That’s why you need to make sure potential respondents can fill out your survey anytime, at any place, on any device, and on any platform.  source: Just in mind

source: Just in mind

To make sure everything goes smoothly, try to run your survey through Google’s Mobile-Friendly Test. This will show you how mobile-friendly your survey is.

9. Review the questionnaire

To make sure your survey won’t disappoint your customers, always check it before sending it out. Ask a friend or colleague to proofread everything. You can also take advantage of tools like Grammarly or Hemingway to avoid any spelling- and grammar mistakes.

Furthermore, don’t ask questions that you already have answers to. When you receive your first feedback, create a database of answers from the previously gathered information.

10. Prevent your from survey being caught by spam filters

Recall how frustrating it can be when you call a company, and there is no chance to talk to an actual person. The same goes for email. People can identify an automated mail quickly. This is why businesses often explore solutions like customer support outsourcing to ensure real human interaction and avoid getting flagged for spam.

To avoid such a scenario, it is better to use your real name or the name of the person from your company (for example, CEO). Using a clear and short email address can also increase response rates.

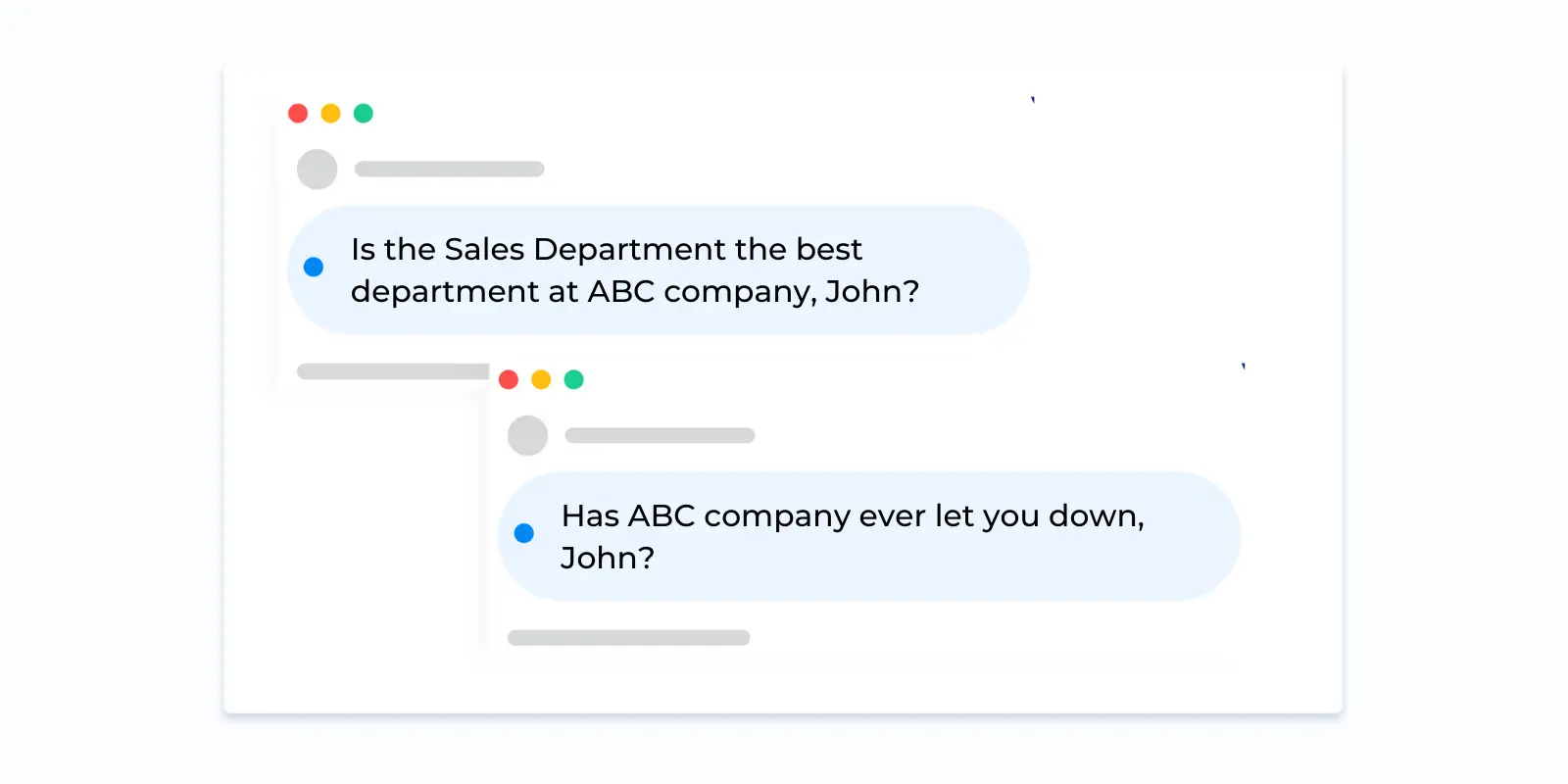

11. Choose a catchy subject line

We all judge emails by their subject lines. So be sure to craft a compelling one to get people to click through to your survey.

If you want to know what subjects work well for email surveys, keep reading.

If you ever received emails from Quora, you might have noticed how they put a question as their subject line.

You can also use an intriguing question relevant to your survey as a subject line.

For example:

- If you want to get feedback from employees: “Is the Sales Department the best department at ABC company, John?”

- If it’s a customer survey: “Has ABC company ever let you down, John?”

It is better to avoid using the word “survey” in your subject line.

12. Give discounts for answers

One of the best ways to increase survey response rates is to offer discounts for feedback. This technique may be of great help if your questionnaire consists of many long or open-ended questions.

But no worries, the price reduction you provide doesn’t have to be huge or applicable to all kinds of products or services. The purpose of this discount is to draw attention to your survey. In some cases, you can even use branded freebies, which could also benefit your brand.

13. Offer an option to share the survey

The more people will share their opinion with you, the larger picture you will get. Let your customers share the questionnaire with friends, colleagues, and family. If you want to encourage active sharing, you can promise a better chance of winning some prize or getting an extra discount if their friends and family take the survey. Make it easy and include a button to share via email or social networks.

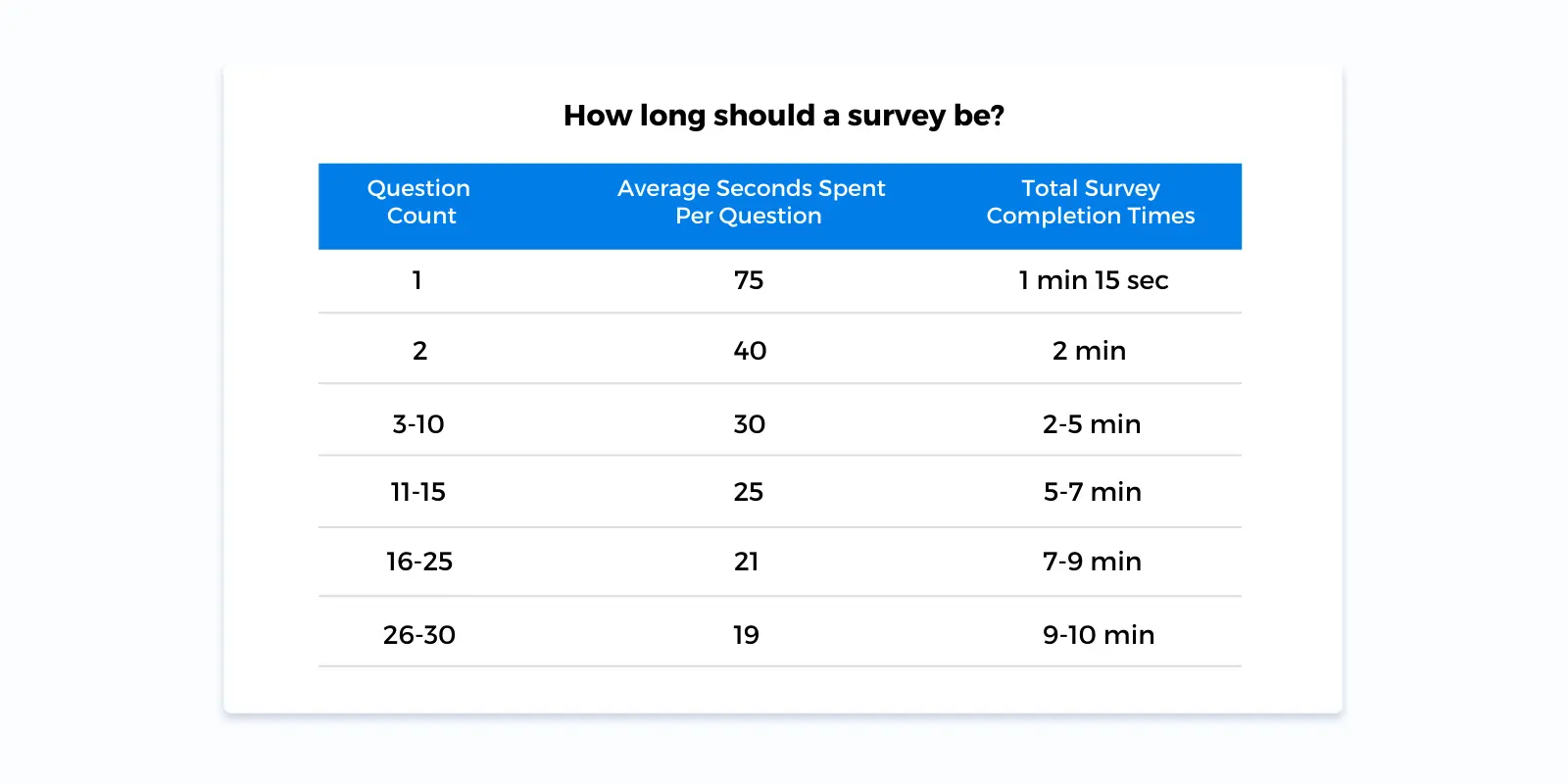

14. Keep it short when possible

Try to keep your survey as short as possible. If earlier people were ready to answer up to 40 questions, with time, companies condensed their surveys to 20 questions and greatly reduced the number of mouse clicks.

source: Survey Monkey

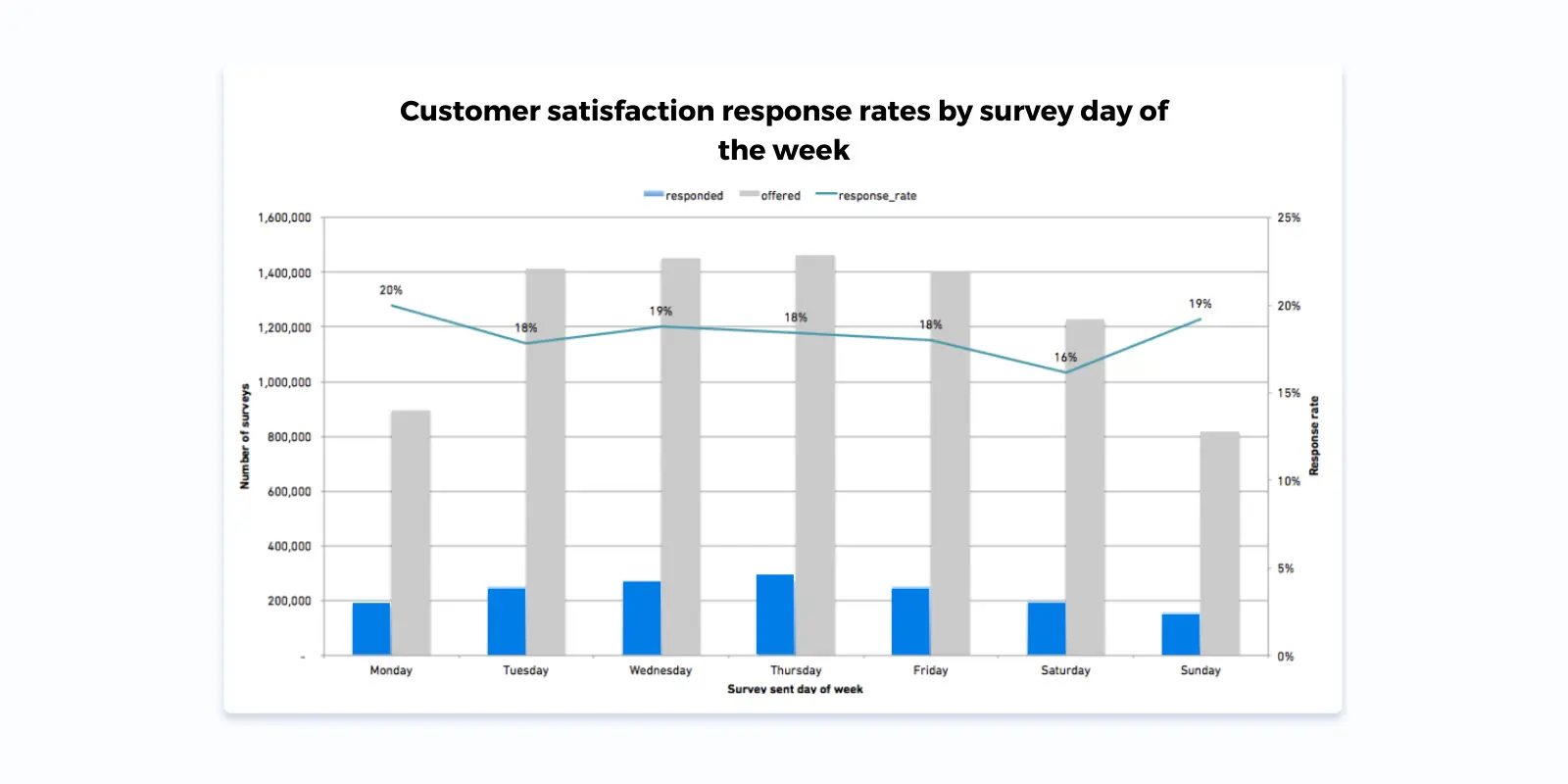

15. Send your survey mid-week, during mid-afternoon

Most office workers start their weeks cleaning their inboxes. The likelihood of your survey being completed is increased by sending it out mid-week, ideally after 12 pm.

16. Keep your email list in order

The quality of your email database is decisive for the success of your survey. Always make sure your subscribers are genuinely engaged with your brand. This will ensure a higher response rate.

17. Do not over-survey your audience

Surveying people too often may result in lower response rates. But how do you know what is the right time? For example, for some services like Airbnb, it’s okay to ask customers for feedback at every touchpoint. But other businesses may need to engage clients once per quarter or even rarer.

source: Hubspot

18. Show gratitude and always take action

Show your audience that you act on the received feedback. Otherwise, next time, they can simply ignore your requests.

Also, keep in mind that saying thank you is the cheapest way to show your gratitude for customer time and effort. This will encourage further fruitful interactions. Here is what you can say:

- Thanks to your feedback, we will make your experience much better!

- Thank you for helping us out. You are awesome!

- Thank you for taking the time to complete our questionnaire.

Conclusion

Looking for the best way to get survey responses? Follow these simple tips to see higher survey response rates and better respondents’ insights:

- Learn more about your target audience beforehand;

- Make your survey invitation personal;

- Explain the purpose of your survey;

- Pay attention to design;

- Don’t wait for too long after you delivered the product or service;

- Choose the right channel to interact with your audience;

- Use a progress bar to let respondents see how long will it take them to complete the survey;

- Optimize your surveys for various devices;

- Double-check the questionnaire before you send it;

- Be aware of spam filters;

- Write a catchy subject line;

- Give discounts for answers;

- Offer an option to share the survey;

- Keep the survey and questions short when possible;

- Clean your email list regularly;

- Do not over-survey your audience;

- Say thank you and take action.